10 Must-have Capabilities for Your AP Automation Solution

20 January 2026

Subhash Sidharthan

Director - DeliverySubhash Sidharthan heads the SAP Services & Localization for Applexus Technologies. Subhash has an experience of over 29 years spanning over consulting, pre sales and delivery...

Organizations adopting AP automation are moving beyond basic digitization to build intelligent, end-to-end invoice management processes that improve control, visibility, and financial outcomes.

The objective is no longer isolated automation. It is to embed intelligence, control, and visibility across the entire invoice lifecycle, from intake and validation to posting, collaboration, and audit readiness.

When done right, automation absorbs the repetitive and error-prone work, allowing AP teams to move away from transactional firefighting and toward high-value oversight, faster decision-making, and predictable supplier payments.

Why Organizations Are Rethinking Accounts Payable Now

AP transformation is accelerating because traditional processes struggle under modern pressures:

- Rising invoice volumes and seasonal spikes

- Increased exposure to fraud and duplicate payments

- Shrinking tolerance for late payments and missed discounts

- Remote and distributed approval structures

- Growing audit and compliance scrutiny

- Demand for real-time visibility into liabilities and cash flow

Manual and semi-automated AP environments create fragmentation; data sits in silos, approvals stall, exceptions pile up, and value quietly leaks from the process.

The result is not just inefficiency, but higher Cost of Goods Sold (COGS), constrained cash flow, and weakened supplier relationships.

Modern Accounts Payable automation enables finance teams to reduce manual effort while strengthening governance across invoice intake, validation, approval, and posting.

The Real Problem with Legacy AP Processes

Across industries, AP teams face consistent challenges:

- Slow, manual workflows that consume disproportionate effort

- Data entry errors that cascade into delays and rework

- Missed early-payment discounts and avoidable late fees

- Limited end-to-end visibility for approvers and leadership

- Disconnected supplier communication across email, calls, and spreadsheets

- Weak fraud controls and audit trails

- Inability to retrieve invoices quickly during audits

- Minimal analytics to identify bottlenecks or value leakage

Fixing individual steps does not solve the problem. What is required is a unified, value-driven invoice management approach. When organizations automate accounts payable, they reduce cycle times, minimize errors, and free AP teams to focus on higher-value financial oversight.

From Automation to Management: A Value-based AP Framework

Modern AP leaders are adopting a Value Map–driven approach to invoice management. A Value Map links:

- Financial objectives (cost reduction, cash flow optimization, compliance)

- Operational levers (discount capture, exception handling, fraud prevention)

- Enabling capabilities (AI, business rules, workflows, collaboration)

This ensures intelligent AP automation is applied where it directly impacts financial outcomes, not just where it speeds up a task.

Instead of asking “How fast can we process invoices?”, the question becomes:

“Where are we leaking value—and how do we stop it?”

This is where an AP automation solution becomes critical, not as a point tool, but as a unified platform that connects operational levers directly to financial outcomes.

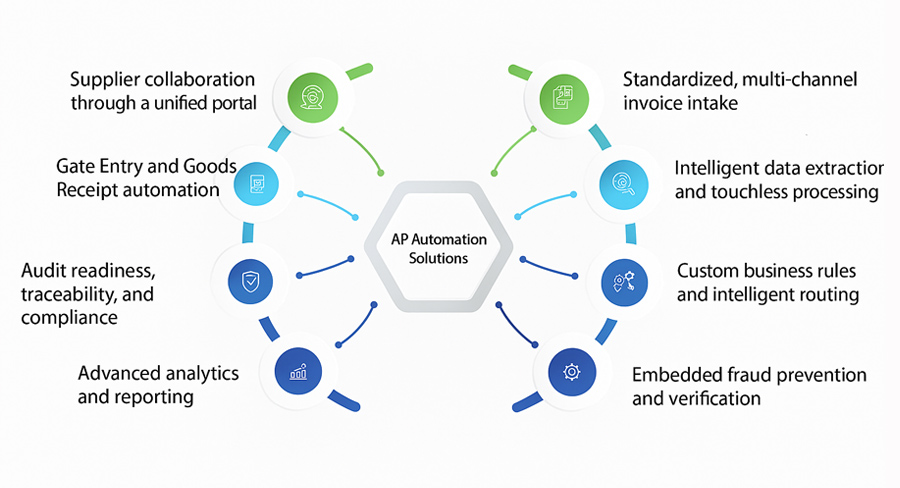

Must-have Capabilities in A Modern Invoice Management Solution

1. Standardized, multi-channel invoice intake

Invoices arrive from everywhere: email, EDI/IDoc, procurement platforms, supplier portals, scans, and PDFs. A modern solution must:

- Aggregate invoices from all channels

- Support PO and non-PO invoices, credit and debit memos

- Ingest invoices in any format, at scale

- This creates a single source of truth from the very first touchpoint.

A modern AP automation solution brings automation, collaboration, intelligence, and control together to eliminate fragmentation across the invoice lifecycle.

2. Intelligent data extraction and touchless processing

AI, ML, and OCR work together to:

- Extract invoice data with high accuracy

- Validate line items automatically

- Learn from corrections to improve future extraction

Straight-through processing reduces manual intervention, shortens cycle times, and supports on-time payments—even during volume spikes. The use of AI in AP automation enables straight-through invoice processing, with self-learning capabilities that continuously improve data accuracy over time.

3. Custom business rules and intelligent routing

AP teams need flexibility without IT dependency:

- Configure no-code business rules

- Define thresholds, tolerances, and exception handling

- Route invoices dynamically based on supplier, amount, region, or risk

- Align workflows with the Chart of Authority

Invoices reach the right approver at the right time—without manual chasing.

4. Embedded fraud prevention and verification

Modern AP systems must actively protect cash:

- 2-way matching for non-PO invoices

- 3-way matching for PO-based invoices

- Duplicate invoice detection

- Bank detail verification

- Supplier risk tiering

These controls operate continuously in the background, reducing financial exposure without slowing processing. Leading AP automation tools embed these controls directly into the invoice workflow to safeguard cash without slowing down processing.

5. Supplier collaboration through a unified portal

A Supplier Collaboration Portal replaces fragmented communication:

- Suppliers can submit, view, and track invoices

- Access PO details and payment status

- Collaborate through a shared workspace

- Upload supporting documents and resolve discrepancies quickly

This reduces follow-ups, improves transparency, and strengthens supplier relationships.

6. Gate Entry and Goods Receipt automation

Invoice accuracy depends on upstream visibility:

- Capture gate entry details at receipt

- Create, modify, or reverse Goods Receipts

- Attach delivery documents within the same system

By integrating inbound supply chain events, AP eliminates reconciliation gaps and downstream exceptions.

7. Audit readiness, traceability, and compliance

Every invoice interaction is logged:

- Time-stamped audit trails

- Full change history

- Secure, centralized document archival

- Instant retrieval during audits

Compliance becomes continuous—not reactive.

8. Advanced analytics and reporting

Real-time dashboards provide insight into:

- Cycle times and bottlenecks

- Discount capture rates

- Exception volumes

- Supplier performance

- Fraud indicators

With cloud AP automation, finance leaders gain real-time visibility into AP performance while ensuring scalability, security, and continuous access to insights.

Sustaining Value with A Value Assurance Approach

True AP maturity doesn’t stop at go-live.

A Value Assurance framework ensures:

- Periodic assessment of realized value

- Identification of value leakage

- KPI-driven optimization

- Continuous alignment between expected and actual outcomes

- Discovery of new value opportunities over time

This is how AP evolves from a cost center into a measurable contributor to financial performance.

Wrapping Up

New-age Accounts Payable organizations are no longer satisfied with partial automation. They are building intelligent, end-to-end invoice management ecosystems that scale, protect value, and deliver continuous insight.

By combining automation, control, collaboration, and analytics on a single platform, AP teams gain the resilience to handle growth, the discipline to prevent leakage, and the visibility to make faster, better decisions. Choosing the right AP automation solution is not just about efficiency; it is about building a resilient Accounts Payable function that consistently delivers measurable business value.

The result is not just faster invoice processing, but lower costs, stronger supplier relationships, improved cash flow, and sustained financial value.

Get Started

Jumpstarting your journey toward a smarter, more connected invoice management is simpler than you think. Explore tailored consultations, solution walkthroughs, and expert-led discussions to see how InSITE brings intelligence, control, and visibility across your Accounts Payable ecosystem. Whether you are looking to automate accounts payable at scale or strengthen controls across complex invoice environments, InSITE provides a structured path toward sustained value realization.

- Learn more about InSITE to understand how it helps reduce value leakage, strengthen financial controls, and improve supplier collaboration.

- Schedule an InSITE consultation to assess your AP landscape and define a clear path toward measurable, sustained value.