Why are you, the CFO, struggling with your digital transformation journey?

15 March 2022

Shiraz Cooper

VP - Finance PracticeShiraz Cooper is Vice President, Finance Practice Leader at Applexus. Shiraz has twenty-five years of global SAP Finance Transformation experience with a passion for helping clients...

During my career advising finance organizations on their transformation programs, the CFO’s role has evolved. Traditionally the job was to protect the assets of the company and meet statutory reporting and compliance requirements. Now in addition to that, CFOs are required to be the primary sponsor responsible for a company’s digital transformation. Considering the rapidly changing technology landscape, this is not an easy undertaking.

CFOs are overwhelmed by hundreds of technology acronyms thrown around at summits, by research organizations, and IT professionals. Consulting firms now more than ever are aggressively selling software solutions and telling Finance how to run their own business. Most CFOs have been scarred by technology implementations of the past which have not provided the promised ROI, and as a result they may no longer share a common vision and understanding with their CIO.

If this situation resonates, you will find my series of blogs a useful guide to help navigate through the hype and reality of today’s technology trends.

Let’s start with the 2 key focus points for every CFO:

- Operational efficiencies to reduce costs, and

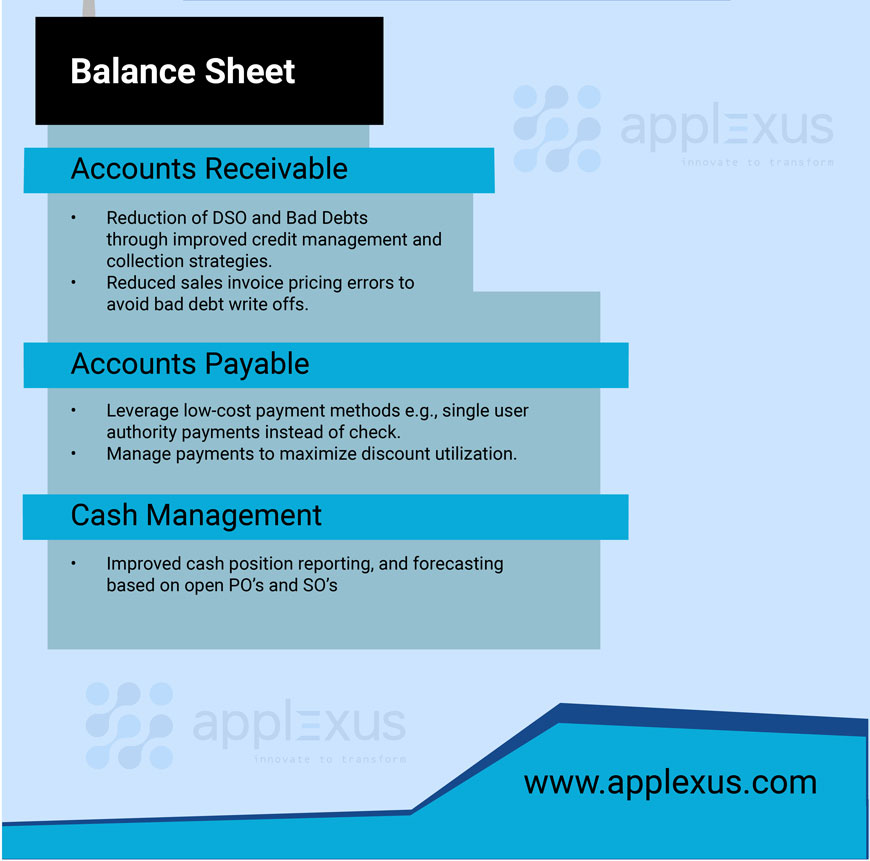

- Strategic decision making to achieve revenue/ profit growth and improve KPI’s. The most important KPI measures are usually FCF (Free Cash Flow), ROE (Return on Equity), DSO (Days Sales Outstanding), GM (Gross Profit Margin), but this may vary across industry.

Whatever technology investment choice you make, it must have a direct impact on both guidelines above, and therefore a measurable ROI!

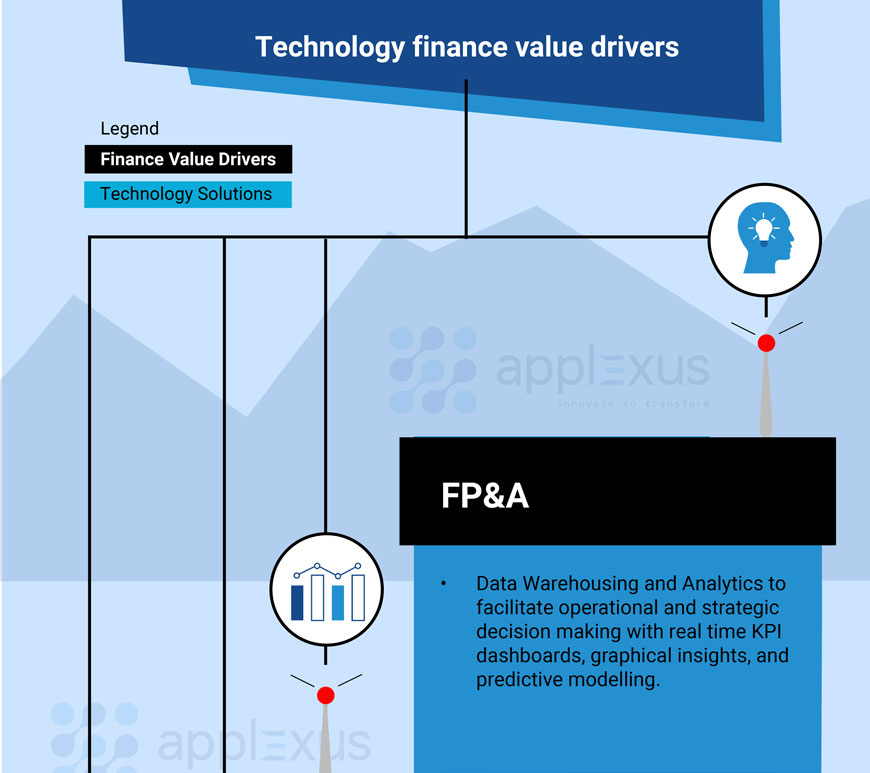

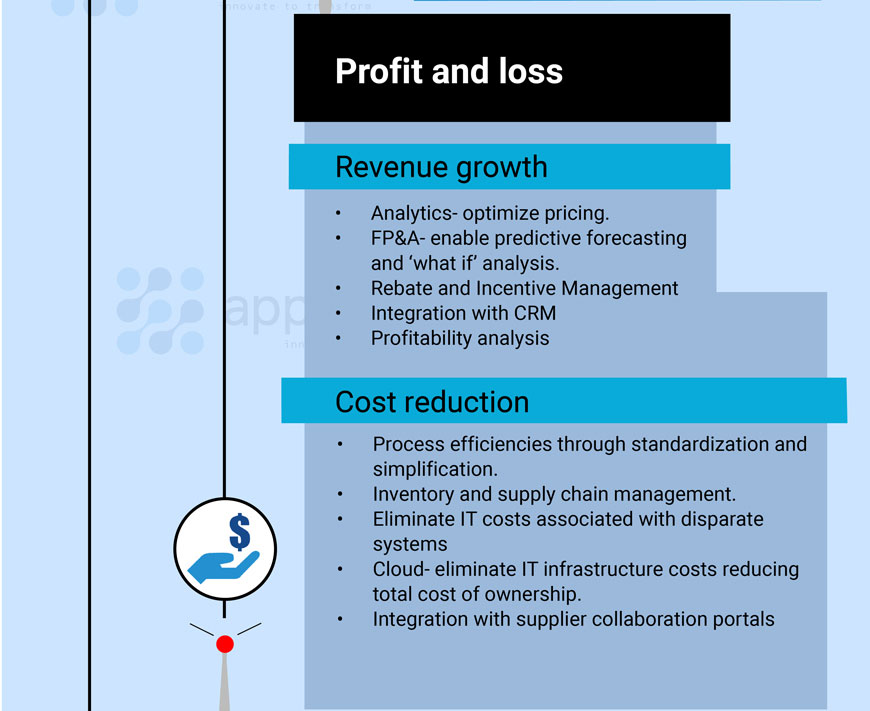

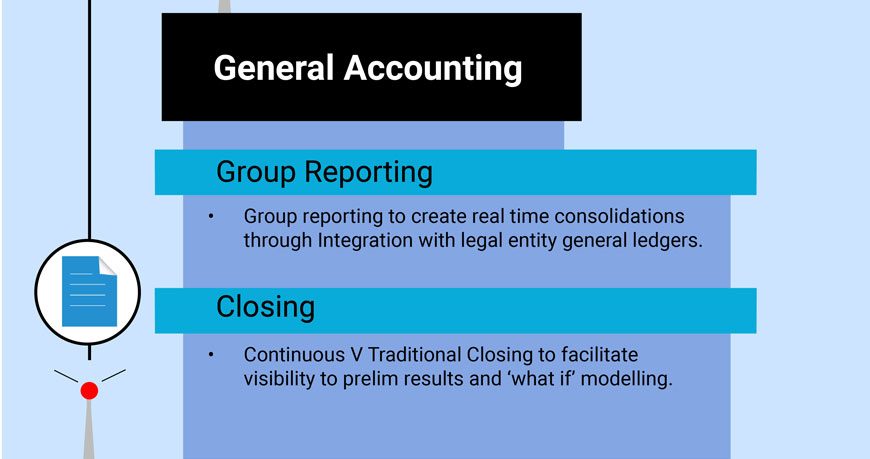

See the Value Map which highlights the Finance Value Drivers which technology can realize

Where do I need to get to? What’s my target operating model?

Before I even start to explain digital transformation, and the technology options available to you, let’s first envision the Finance organization of the future and your target operating model. First and foremost, around 50% of your processes can be automated.

‘40 percent of finance activities (such as AP, AR, and general accounting) can be fully automated, and another 17 percent can be mostly automated’

- McKinsey 1

Approximately 25% of finance activities can be outsourced, thereby leaving 25% for your onshore finance team. They will most likely be employed in advanced FP&A to drive performance, and project work collaborating with other departments to seek strategic improvements. Your team will be empowered to focus on more intellectually demanding and creative operational and strategic work, in collaboration with the rest of the corporation.

A significant proportion of your IT applications will be deployed in the cloud, therefore reducing related infrastructure costs by approximately 30 – 50%, and almost all your IT support will be outsourced to a lower cost AMS (application management services) organization model.

If all that sounds over ambitious, then the pressure is on to get with the flow! Some corporations are closer to this model than others, and unsurprisingly they are also the higher performers.

What does Digital Transformation mean?

Now that we have a vision for the Agile Finance Organization of the future, let’s look at the technology that’s going to get you there. First and foremost, the term Digital Transformation which has been brandished indiscriminately needs explaining. Digital Transformation is a very general term used to describe the use of technology to improve your business model. The term makes no reference to any specific technology, nor does it allude to the definition of ‘transformation’. It is open to interpretation, but I believe Digital Transformation is synonymous with defining an ERP modernization program as the foundation of your technology roadmap.

ERP (Enterprise Resource Planning)

Back in 1992 when I was working in Audit for one of the big 4 consulting firms, and only 6 years after Microsoft launched windows (gosh I am showing my age now), SAP released R/3 and with it they pioneered the acronym ERP. It was revolutionary for the time and dispelled the need to have a multitude of disparate software products with accountants constantly collecting and reconciling data between them all. It meant that a typical manufacturing company could create a SOP (sales operating plan), generate a PP (production plan) integrate it to a BOM (bill of materials), then run an MRP (materials requirement plan), to create POs against which materials could be received and issued to production. During this process the financial general ledger, cost and profit centers would all be updated in real time with actual and planned data. All this integrated functionality and more in one software solution! Many organizations jumped on the band wagon, and many of the fortune 100 companies implemented SAP R/3 to enable them to scale their businesses and force process re-engineering and improvement. The rest is history.

Today most medium and large companies have an ERP globally operational in one form or another. Most acquisitive organizations have inherited several independent ERP systems possibly by different software vendors. The majority however will be running their businesses on SAP’s ERP. As with all technology once you are bought into a vendors product ecosystem, the pressure to upgrade and modernize will always be with you. Each upgrade brings with it new and improved functionality, some more significant than others.

SAP’s move to require customers to get off its R/3 version to ECC 6.0 within a few years of the 2008 crash was hugely unpopular. The implementation and increased licensing costs came at a time when all companies were economically struggling. Moreover ECC6.0 made no promise of material functional improvements. By contrast, SAP’s latest ERP product offering, S/4HANA, is rapidly gaining market traction and upgrading to it has become the focus of Digital Transformation roadmaps.

So why the hype with SAP’s latest and greatest, S/4HANA? S/4HANA is short for fourth version of SAP’s Business Suite designed to run on the database called HANA (High Performance Analytic Appliance). The data base design and architecture has changed to embrace ‘in memory’ computing which enables faster access of larger volumes of data. Outlined below are some of the business benefits introduced by this new release.

- Cloud compatibility: most importantly S/4HANA is your route into a cloud ERP solution. It can also be deployed on premise, but a cloud deployment significantly reduces your total cost of ownership and comes with faster implementation and upgrade times.

- Improved analytics with both dashboard and graphical style visualization of KPI’s.

- Predictive planning and ‘what if’ modelling capabilities.

- Process simplification by enabling users to access functions via apps through a web browser, this new user interfaced is named Fiori. On a side note, Fiori means ‘flower’ in Italian, and HANA is the Japanese equivalent.

Apart from ERP systems, there are other technologies which are relevant to an organization’s transformation journey, and I will cover them in the next blog in the series: Other technologies to consider in Digital Transformation

Conclusion

A prerequisite to any digital transformation journey is a one-to-three-year roadmap which is closely tied to your financial value drivers. A business advisory service must be considered to assist you in formulating your value proposition and putting the measures in place to ensure you are getting out of IT investment what is promised.

Make ERP modernization central to your Digital Transformation roadmap. If you are running on SAP’s ECC6.0 version, you have until 2027 to upgrade to S/4HANA. After 2027, ECC6.0 will only be supported by SAP with uplifted support fees.

Until now, I have spoken only about monetizing your technology journey, but allow me to throw in ESG (environmental, social and governance). It is a set of standards for organizations against which they can be measured by socially conscious investors. As part of Finance’s evolution, so too is the idea that ESG can drive financial performance, however it would be naive to believe that conflicts do not arise. In addition to your digital transformation, make an ESG one too; adopt a culture of trust, transparency and credibility with your consumers and broader community by making your performance not only profitable, but also responsible!

So far, I have only introduced ERP modernization, however there is more to consider in your Digital Transformation journey. Please follow me at Applexus so that you don’t miss my blogs/ webinars coming up:

- Other technologies to consider in Digital Transformation

- A Finance First methodology to Digital Transformation

- A more detailed look at SAP S4/HANA V ECC6.0, and the benefits of ERP modernization

- Video podcast series covering all things digitally Finance relevant

1 “New technology, new rules: Reimagining the modern finance workforce”, Steven Eklund, Michele Tam, and Ed Woodcock, November 2, 2018 - McKinsey

Let´s Connect

Feel free to reach out to me at bilal.athar@applexus.com if you would like an informal ch at about your Finance Transformation challenges.