CFO- Why Should I Invest In Yet Another SAP Upgrade?

Introduction

I have seen too many SAP upgrades end up as just technical IT upgrades with no exploitation of the newly introduced functionality to create business value. If there is one message that must be emphasized, it’s this:

Don’t make your upgrade to S/4HANA about IT! Seek out the business value that can be realized from the new solution and hold your CIO and IT organization accountable for delivering it!

S/4HANA is your ticket to lower ERP total cost of ownership, improved operational efficiency, and data enlightenment. Make it happen!

In my previous blog titled ‘Why are you, the CFO, struggling with Digital Transformation journey?’, I stressed the value of making an ERP modernization program central to your Digital Transformation Roadmap. Today 60% of fortune 500 companies are running their businesses on SAP’s previous ERP version released in 2005, called ECC6.0 (enterprise core controlling release 6.0). In 2014, SAP released their latest ERP solution called S/4HANA, and if you are among that 60%, you have until 2027 to upgrade. Failure to do so will increase your support costs, create compliance risks, and diminish your ability to compete in an increasingly IT-driven commercial world.

The chances are high that your CIO is on to it, and this significant upgrade is high on his agenda. After all, his job is to push technology innovation into your organization and create a secure IT infrastructure which supports your organization’s growth. It’s worth saying again — don’t make your upgrade to S/4HANA about IT!

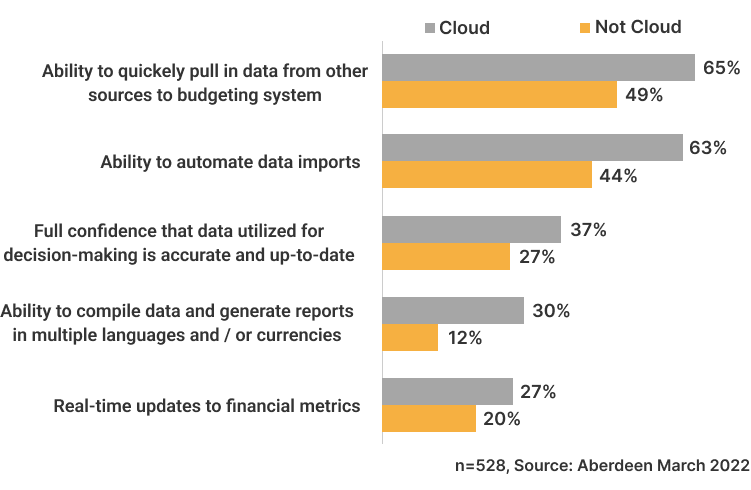

Unlike ECC6.0, S/4HANA is a cloud-compatible solution. If deployed, it will significantly reduce your infrastructure and upgrade costs while enabling you to scale your ERP solution with the needs of your growing business. The two alternative approaches to cloud deployment are private and public cloud, but I will get into this in another blog. The table below is a comparison of companies with cloud-based ERP vs. on-premise ERP. Sited from Aberdeen Strategy & Research 2022.

Cloud-Based Comparison of Management Advantages 1

OK, let’s finally get the elephant out of the room. I will now overview the main Finance benefits of transitioning to S/4HANA from ECC6.0 in order of what I believe to be the most significant. Of course, your priority order may differ depending on your organization’s specific needs.

Improvements in S/4HANA Finance

Financial Planning & Analysis

Imagine a tile/widget on your desktop and mobile device showing your Gross Margin % (GM), Days Sales Outstanding (DSO), Cash Position, or Return On Capital Employed (ROCE), all ticking away in real time! Of course, these are real-time preliminary numbers before you book your typical period-end adjustments. Imagine you click on one of these widgets, let’s say the GM% one, and you see a simple graphical representation of how your GM% has moved year to date with a predictive line estimating where it will be at the end of the current period. Then you click further and are in the details of which products yield the highest GM% and variance compared to prior periods. This is you truly running your business in real-time without waiting until the period-end to make an operational and strategic decision — the ideal instance of data enlightenment!

The data architecture in S/4HANA has been transformed and simplified. I will not bore you with all the technical details, but this is by far the biggest innovation of the product. It has enabled serious analytics power, visualization, and prediction with a concept called embedded analytics and a new extension called SAP Analytics Cloud (SAC). ECC6 required costly programming or query writing to create custom reports accessing data from various fragmented tables. In contrast, S/4HANA Finance provides the data in visual graphical format, enabling drill down with predictive analysis, all sourced from a single table and source of truth.

By introducing visual KPI executive dashboards, SAC turbocharges your analytics function and provides opportunities to improve your financial planning and budgeting processes. The P&L, balance sheet, and cash flow financial planning process is now integrated and enables improved collaboration with other teams and plans in your organization, sales, production, and department planning. AI-based predictive planning and what-if scenario data modelling enhance the planning process further. Good planning drives results instead of simply measuring them!

Robotic Process Automation (RPA)

Let’s envision the Finance organization and target operating model of the future where 60% of finance processes will be automated. Talk of RPA has been trending in the marketplace for the last 3 years, with companies such as UI Path and Blue Prism leading the pack with their software solutions. SAP is jumping on the bandwagon and has delivered approximately 100 predefined automated processes in S/4HANA Finance 2021.

The phrase Process Automation is self-explanatory but prefixing it with the word Robotic conjures up images of robots walking around the corridors of Finance preparing management accounts, but let’s not get ahead of ourselves. RPA fits nicely in the automation of repetitive large volume processes. Typical use cases for RPA digital workers, otherwise known as bots are as follows:

- AP vendor invoice processing, invoices are matched to the corresponding POS and routed for approval or other actions depending on the details of any variances.

- Credit control, customer credit scores are checked to release credit-held orders based on predefined criteria.

- Customer and Vendor master data creation.

- AR invoice generation, distribution, and cash application.

- Dispute resolution and automated messaging.

- Extracting data, preparing and submitting reports.

Many organizations struggle by applying RPA to broken processes or to ones which are too complex and contain numerous exceptions. My recommendation is to start with less complex, high-value, and repetitive processes. In this context, less complex processes are those with no exceptions, require no manual intervention, and contain few and simple logical decisions. Once you go live and gain momentum with these and have the infrastructure and governance framework established, your runway to automation can be scaled to the entire organization.

Margin Analysis

In ECC6, Profitability Analysis (COPA) is the submodule used for slicing and dicing your gross margin (sales less cost of sales) by various data dimensions such as customer, product, service, region, department etc. However, in my early consulting days, clients were always confused by the various options for configuring COPA. To make matters worse, it was always painful reconciling the results to your GL, and the results were never real-time due to the need to periodically transfer overhead, production, and project-related costs to COPA.

Now in S/4HANA Finance, SAP has rebranded Profitability Analysis and renamed it Margin Analysis, and all the disadvantages noted above have gone! Margin Analysis provides real-time slicing and dicing of your actual margins besides your planned margins (unbilled sales orders). This data insight is also available in SAC which I described in the earlier section titled ‘FP&A’.

Receivables Management

As a CFO, you have a close eye on the money coming in and the invoice to cash process. Your hot buttons in this area are probably reducing your Bad Debt to Sales% and Days Sales Outstanding%. Let’s look at the opportunities in S/4HANA Finance not available in previous releases to help you get there.

Credit, Dispute and Collection management processes have been significantly improved. Real-time credit checks on all sales orders, automatic calculation of customer scoring and credit limit updates reduce your exposure to credit risk and bad debt. Workflow-based dispute management and collection strategies directly reduce DSO. Furthermore, in S/4HANA Finance, SAP has introduced a solution called CCP (customer cloud payments) for self-service enabling customers to view, pay and manage their invoices. CCP has the potential to significantly reduce your cost per sale and allows customers to access their account balances and electronic invoices through a portal and apply payments using various payment types. They can manage their own customer information and automate payment runs to you through the portal. If required, they can also collaborate and dispute invoices over the portal. The benefits are significant: no invoice printing, reduced AR time on cash application, a real-time collaboration hub for disputes, and a means of automating incoming payments. Unfortunately, CCP comes with additional license fees, but I recommend at least conducting an ROI evaluation to justify those additional fees.

Advanced Financial Closing

A faster and more efficient financial close provides your executive team with early access to your results and analysis, empowering them to make quick and informed decisions to be competitive. Top performers close in 5 days or less, most companies close around 6 days, and the bottom 25% close in 10 days or more. If you are in that bottom group, then the chances are high that you are not making the best use of your ERP to automate or improve the efficiency of your processes. Poor data quality and a lack of governance may also add to your closing pains.

If your closing days are greater than 6, you should prioritize seeking opportunities for optimization using S/4HANA’s Advanced Financial Closing. It is a tool for getting your closing timetable and tasks off excel and into an orchestration and automation hub. It allows all closing activities to be organized, scheduled, and automated, with workflow approvals, across all your global legal entities irrespective of which version of the instance of SAP they are on. You, the CFO, can overview the status of all closing activities in all legal entities with drill-down visibility to approvals and supporting documentation, all in an easy-to-use web app. Additionally, the tool enables your finance team to manage all their dependent closing activities during a stressful time.

Predictive Accounting

What SAP calls predictive accounting in S/4HANA Finance is not as revolutionary as it sounds and is certainly not rocket science! It simply translates to predicting the revenue and COGS of open sales orders and flowing that information into simulated analysis. The example I provided in the FP&A section, where clicking on a GM% widget could show you a predictive line estimating your future GM% movement, uses the concept just described.

Cash Management

Bank account management in S/4HANA Finance has been significantly improved. Previously in ECC6, IT had the task of configuring new bank accounts and linking them to the GL. It was astonishing how such an essential business function lay in the hands of IT. Now in S/4HANA Finance, the management of bank accounts has been pushed to Treasury users. Bank accounts can be opened or closed during a workflow approval process and can be grouped in hierarchies to enhance cash position reporting.

Various other improvements have empowered Treasury to manage cash and liquidity better. Tiles and apps are available to show at a glance the status of your electronic bank statement uploads. In turn, this informs your daily Cash position, which is also represented on a tile. Additionally, a bank communication monitor is available to facilitate batch payment approvals after AP payment runs and reconcile bank-processed payment file instructions.

Universal Allocations

Back in my early consulting days prior to S/4HANA, it was always left to us finance consultants to configure cost and profit center allocation cycles. It was the user’s job to execute them at the period-end. However, if a department head wanted some traceability on the operating costs allocated to his department, he would have to endure a very cumbersome process of executing various reports to trace them back. Therefore, the management and reporting of Opex in ECC6 were hindered by a lack of transparency.

Now in S/4HANA Finance, the management and execution of allocations are significantly simplified for the user through browser apps, and allocated costs can be traced back to their sending cost or profit centers through an app showing an easy-to-understand allocation flow diagram. Furthermore, the top-down distribution of aggregate costs to your margin analysis is also simplified. Such transparency and simplification empower users to get a handle on their Opex and seek out opportunities for cost reduction.

Conclusion

OK, I know I am repeating myself, but please let me say it just one more time:

Don’t make your upgrade to S/4HANA about IT! Seek out the business value that can be realized from the new solution and hold your CIO and IT organization accountable for delivering it!

Most of the clients I have worked with decided to upgrade from ECC6 to S/4HANA without scoping or implementing the newly available functionality. This is what we call a ‘Lift and Shift’ in consulting, and yes, it’s a great way of simplifying your transformation roadmap. Additional S/4HANA business value functionality can easily be implemented and leveraged during a second phase. However, in many cases, I have seen this second phase get delayed, deferred to other projects, or eventually forgotten. Ensure this does not happen, and go with the momentum of your program by scoping how best to profit from S/4HANA using its enhanced functionality!

I have discussed the main Finance benefits above, but many others exist because of general process simplification, a much-improved app-based UI, and improved functionality in areas outside Finance. Enjoy your ERP modernization journey, but above all, ensure it positively impacts your top and bottom line!

At Applexus, our Finance Practice service offerings are closely integrated with our Analytics and Business Advisory practices. Finance doesn’t stand alone, but it is the foundation of corporate digital transformation. Feel free to reach out to me if you have any questions or simply want to know more about what we do and how we can help.

1 Bryan Ball, How Cloud-Based efficiency and innovation address finance challenges. Aberdeen Strategy & Research